Average Car Allowance for Sales Reps

However your car allowance can also depend on other factors such. Average fixed car allowance in Canada.

What Is The Average Company Car Allowance For Sales Reps

When tax season comes around opting to use a car allowance will cost you more money too.

. For every 100 paid in monthly car allowance 38 is. Lets realistically compare a mobile employees take-home pay with work expenses. They were paid a monthly amount to cover these expenses.

8200 for senior managers. In the past I have paid sales reps a fixed amount for auto cell phone and laptop expense. But for most mobile workers its 575.

6500 for middle managers. The average annual car allowance for company heads is 10300. A recent survey found that the average car allowance in the UK is as follows.

50000 - 65000 a year. Anywhere from 20000 per month to 100000 per month. Car allowance and travel expenses paid.

As of Apr 2 2022 the average annual pay for a Car Allowance in Texas is 49372 an year. All sales reps were required to have a late model car or truck in clean condition a cell and a laptop as a condition of employment. Just in case you need a simple salary calculator that works out to be approximately 2374 an hour.

And believe it or not the average car allowance in 2020 was also 575. MileIQ says companies use car allowances to minimize accounting costsOnce an employee has been allocated a car allowance that amount is simply added to the employees paycheck. 30 days ago.

However instead of just offering an entire car to an employee more and more companies are moving towards a car allowance system that frees up the choice of vehicle for the employees and removes the stress of having to maintain the car. What is a normal car allowance. Employers must be careful when providing a non-taxable car allowance.

A company can avoid taxation by tracking the business mileage of its employees. The average monthly car allowance for Sales Reps is 575 per month. This allowance may be greater for different positions in the company.

The percentage of business use for Jackson is 1030K0003 or 333. And believe it or not the average car allowance in 2020 was also 575. While there arent any average car allowance rates or data we usually come across figures ranging from 18000 to 20000 per year.

Sales representatives directors and managers typically receive a car allowance. This means that 575 on average is added to an employees salary every month. If you are paying a 600 car allowance to California employees it could pose serious problems.

If the amount is too low or too high then it would be considered taxable. For an employee this can be a great benefit. Then you need to include a car allowance clause in the employees contract.

A car is still part of the compensation packagejust look at the job ads for sales reps says Babej. Senior managers middlejunior managers and sales representatives receive 8200 6500 and 5200 a year on average respectively. 5200 for sales representatives.

Automobile and motor vehicle allowances. Nature of car benefit. Executives for example may receive an allowance of around 800.

While there arent any average car allowance rates or data we usually come across figures ranging from 18000 to 20000 per year. Our 2020 survey found that the average car allowance last year was a bit under 600month. Company executives generally receive higher car allowances between 1000 and 2000.

In my 9 years here at PEO Canada I have seen many variations of car allowance amounts. An allowance is taxable unless it is based on a. This means that 575 on average is added to an employees salary every month.

How Is A Car Allowance Calculated. Have some experience in a retail or sales environment. Therefore any money you paid to your employees as a car allowance is taxable just like wages.

The average monthly allowance for mobile workers is 575 while the average monthly allowance for executives is 830. The average car allowance in 2021 is 575. However your car allowance can also depend on other factors such as your role in the company and your salary grade.

An allowance is any payment that employees receive from an employer for using their own vehicle in connection with or in the course of their office or employment without having to account for its use. Monthly allowances for Sales Reps typically equal 575 at mostAt a minimum one earns 575 a month on average. A car can still be considered a sales tool and the kind of car is the extension of their brand.

Professionals receive the lowest average allowance of 4600 -- less than half the allowance for company heads. The average monthly car allowance for Sales Reps is 575 per month. You will be responsible for selling our range of products to new.

The employee then receives the lesser of the car allowance amount and the mileage rate multiplied by. The IRS sees car allowances as a form of compensation rather than a reimbursement for travel. Employee Car Allowance Rates.

This is the equivalent of 949week or 4114month. Every month each employees mileage is multiplied by the IRS mileage rate 0585mile for 2022. This payment is in addition to their salary or wages.

The average car allowance in 2021 is 575. This means that 575 on average is added to an employees salary every month. Employee A receives 600month allowance but nets 360 after taxes.

A company car allowance is a predetermined sum paid to an employee as compensation for driving his or her own vehicle for business reasons. The average monthly car allowance for Sales Reps is 575 per month. In Australia company cars are generally seen as standard practice.

According to a vehicle-related benefits survey in 2011 by World at Work the average car allowance per month is 500 to 900 depending on the position of the employee. 51 rows Weve identified 11 states where the typical salary for a Car Allowance job is above. 10300 for company heads directors c-suite individuals.

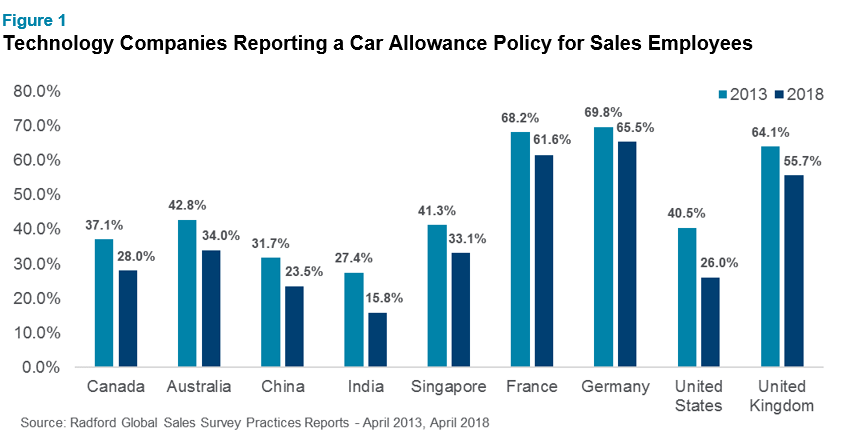

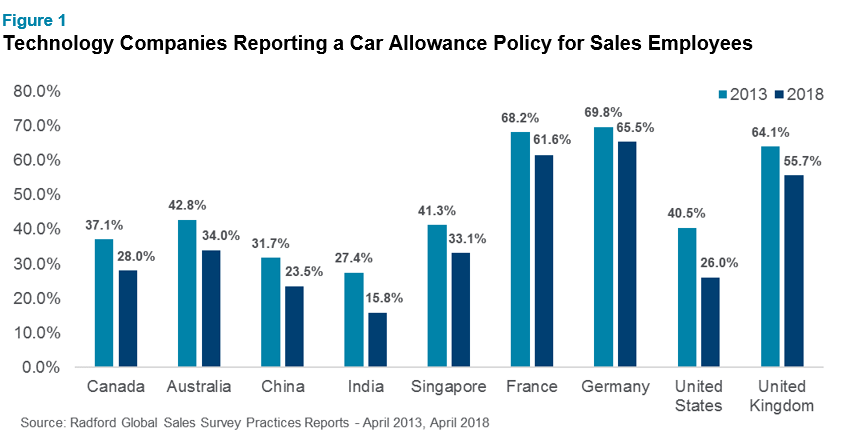

Fewer Sales Organizations Are Offering Car Allowance Plans Across The Globe

What Is The Average Company Car Allowance For Sales Reps

Fewer Sales Organizations Are Offering Car Allowance Plans Across The Globe

Comments

Post a Comment